I signed up for Revolut in 2015, shortly after it launched, amidst the Greek capital controls era. It has been seven years since I started using it as my main bank account. This is my review.

In the beginning

Having capital controls is quite crazy and Revolut was a breath of fresh air. Revolut was indeed a revolution in 2015, especially as an antagonist of the Greek banking system.

I loathed every second I had to spend in a bank branch to do utterly ridiculous things such as “confirm my details”. Having a mobile-only bank sounded great by definition.

Apart from that, though, Revolut offered many more benefits. Specifically:

- Currency exchange, no fees

- Send money all over Europe, no fees

- Freeze/unfreeze cards instantly

- Unlimited new/replacement cards, free

- Virtual cards

- Easy card PIN control

In medias res

In general, I was very happy with Revolut from 2015 to 2020. Lots of progress thoughout the years, although I’m not using most of these features. These are things like stock/cryptocurrency trading, savings accounts, donations, rewards, phone/travel insurance.

In parallel, they started selling premium plans and limiting free stuff. I was expecting that and because I really liked the company, I signed up for their first premium plan and subsequently Metal, the most premium of their plans.

Currently

The cycle of disruptive startups who become evil corporations has tired many more before me. In our futuristic era, this cycle has seemingly sped up. I reckon it will take Revolut half the time it took Google to be hated by a significant percentage of their users.

But, what happened? While I was cruising through the years as a paying member, free users were introduced to the concept of fees. Namely, for:

- Card delivery

- New/replacement of cards

- International payments

- Currency exchange

- Currency exchanging an uncommon currency

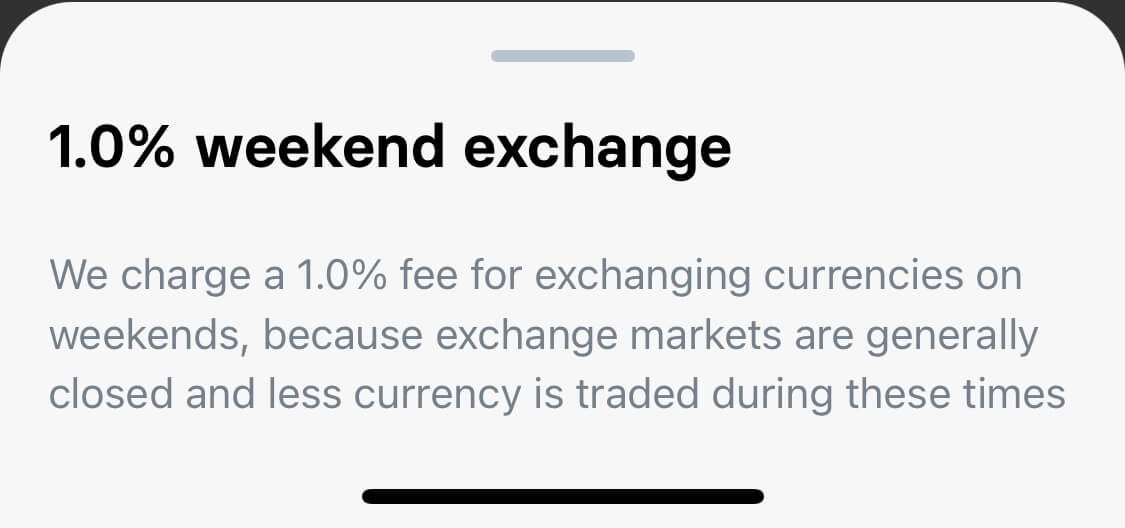

- Currency exchanging when the market is closed (aka weekend fees)

In 2022, most of these fees exist in their most premium plan, the Metal plan, as well. This makes their Metal plan quite weak.

The reason I liked Revolut and started paying for Metal was to be unconcerned about fees. Now, I can’t do that. If I order something online in a currency that’s not GBP, I have to be careful not to do it on the weekends, because there is an extra 1% fee. This is silly. It’s also the oldest trick in the book of how to build a bank and become the most hated business entity across all industries. Fees, conditional on time of transaction, hidden from the UI—that’s why I chose to give up all other banks and go to Revolut—not the opposite.

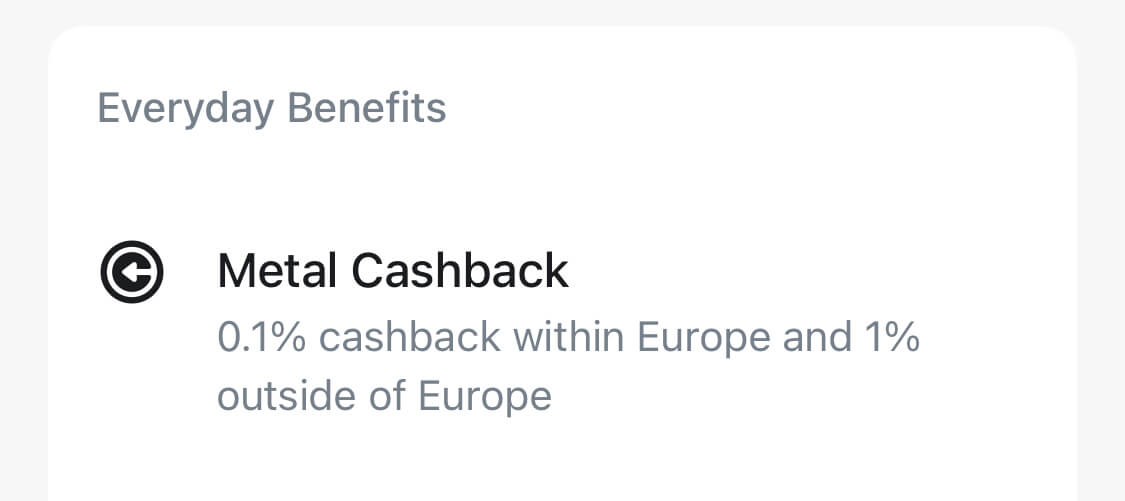

But, the most ridiculous thing in the prestigious Revolut Metal Plan is a thing called Metal Cashback. I subscribed to Metal in 2018 and my Metal Cashback is ~£72 without ever withdrawing from it. But what’s more fun, is that they—not from the beginning though—capped the monthly cashback to be up to £12.99—the exact monthly cost of the Revolut most prestigious Metal Plan. This shows they are not serious about this feature; it’s just a trick to make subscribers justify the plan’s cost to themselves.

To conclude about the Metal plan: I don’t like it anymore. I still have to worry about fees and I cannot even trust Revolut for telling me if they introduce or change fees. Further critique, about Metal cards: low quality, they fall apart even with ordinary use.

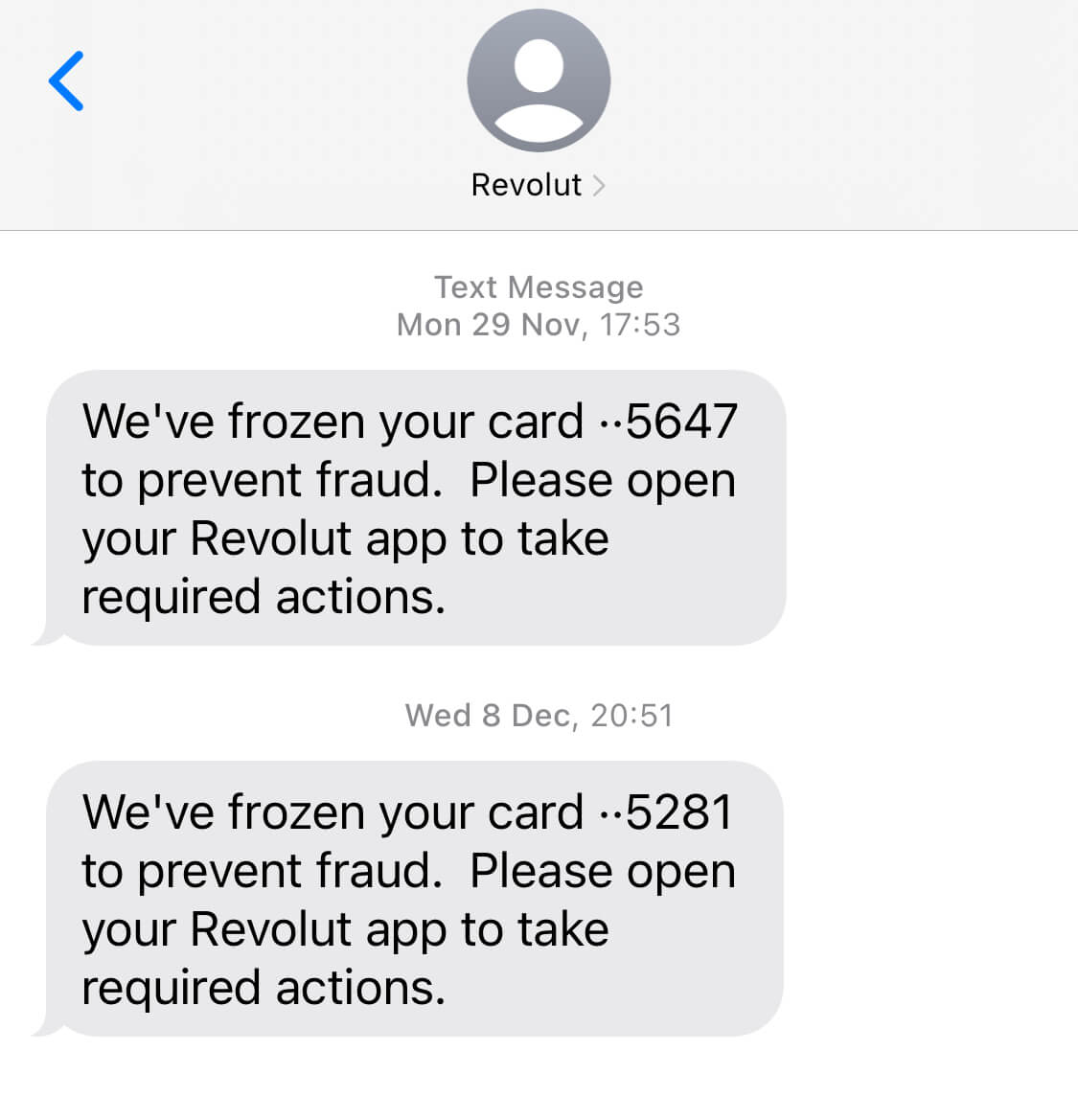

The other issue I have with Revolut (but not with their premium plans) is their fraud false positives. I’m getting—on average—one transaction blocked per month because it’s being flagged as not being initiated by me. Please, Revolut AI, really: it is me who did these transactions.

Prospectives

Is there hope for a subscription-based no-fees bank? During the last 7 years I have tried: Revolut, Monzo, N26, Starling, TransferWise, Bunq, Monese, Atom Bank, Neat, Tandem.

Monzo is my favourite these days. 10 out of 10 app, 10 of 10 business account, 10 out of 10 onboarding. And... zero fees on EUR payments—imagine when: even on weekends! Or at least that’s what they say. I haven’t tested it yet, so not sure if their exchange rate is as good as Revolut’s.

I’ll try signing up for Chase, as well. Rumours are it has launched in the UK.

Epilogue

Sad how Revolut has evolved. I had even met the CTO once and we had some interesting discussions. He asked if I had any feedback. Now, all I can feed back is that it’s cool Revolut supports so many currencies.

Post-epilogue reflection

At the end day, this text is about one person being disappointed about his bank. Big whoop.

I regret even writing it. Don’t read it!